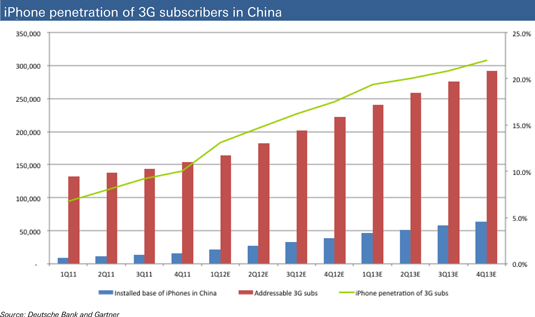

3G addressable market to grow from 40 million in 2011 to 150 million in 2012 for a growth of 273% Y/Y.

Following Apple’s robust results for its most recent quarter preceding the release of this posting, one investment bank takes a closer look at the opportunity for Apple’s iPhone in China on both a short-term and long-term basis.

Deutsche Bank estimates Apple shipped approximately 6 million to 6.5 million iPhones into China in the March 2011 quarter as Apple benefited from the iPhone 4S launch and the addition of China Telecom as a partner in March.

In the short term, the bank expects iPhone momentum to slow in China as the 4S cycle matures and as a result of post-Chinese New Year seasonality.

However, the bank feels the longer term opportunity for Apple in China remains enormous.

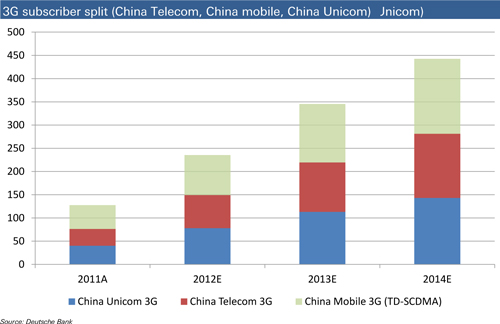

As outlined in more detail below, the bank expects China Telecom and China Unicom to approach 300 million 3G subscribers exiting 2013; while adding approximately 75 million 3G subscribers in 2012 plus, approximately 70 million subscribers in 2013.

If Apple were to add China Mobile, the bank foresees Apple’s addressable market would jump by an estimated 125 million 3G subscribers in 2013.

In 1Q, Deutsche Bank estimates Apple has captured less than 15% share of China Unicom and China Telecom’s combined 3G subscriber base. Over the next few years, the bank expects Apple to benefit from strong 3G subscriber growth at both of these two partners while continuing its path of share gains.

If Apple reaches 20% to 25% penetration of this subscriber base by the end of 2013, Deutsche Bank estimates iPhone unit sales in China would approach approximately 25 million units in 2012 and approximately 35 million units in 2013.

Deutsche Bank feels any benefit from a future partnership with China Mobile would be additive to these estimates.

While the iPhone 4S launch in China was impressive, the bank believes the addition of China Mobile and / or iPhone 5 launch are likely to be even more meaningful. (OEM Exclusive: Request list of EMS/ODM providers anywhere in China or the greater Asia region)

iPhone capture rate in China – new 3G subs vs. iPhone units

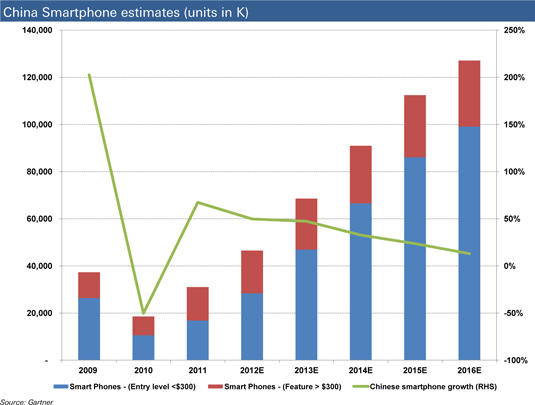

The Chinese handset market is large and growing

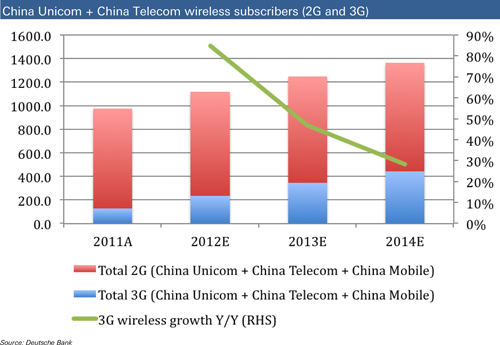

From the carrier perspective, the report states Deutsche Bank’s Asia colleagues estimate Chinese wireless subscribers will grow from 975 million in 2011 and approximately 1.25 billion in 2013 (or 12% to 15% Y/Y).

3G subscribers are the smaller portion of this subscriber base but growing quickly (3G subscribers in China growing 85% Y/Y vs. 2G growing 4% Y/Y).

Deutsche Bank estimates 3G China subscribers of 128 million in 2011 (or 13% of total) and 350 million subscribers in 2013 (or 28% of total).

Over time, the bank expects the mix of 3G / 2G phones to shift from 87% / 13% in 2011 to 67% / 33% by 2014.

Consequently, Deutsche Bank states in the report it believes the iPhone is extremely well positioned to capture the tremendous growth in China and the long-term opportunity for the iPhone in this market is substantial.

China smartphone estimates (units in K)

China Telecom starting to ramp; future China Mobile could be huge

Earlier this year, Apple began selling the iPhone through China Telecom (vs. China Unicom exclusively). In addition, Deutsche Bank Asia colleagues estimate China Unicom will have 78 million 3G subscribers in 2012 growing 50%+ to 143 million in 2014.

Similarly, Deutsche Bank states in the report it expects China Telecom will grow from 71 million 3G subs in 2012 to approximately 140 million by 2014 (CAGR of 55%+ Y/Y).

In short, the bank states it expects Apple’s 3G addressable market will grow from 40 million in 2011 (China Unicom exclusively) to approximately 150 million in 2012 (China Unicom + China Telecom) which represents growth of 273% Y/Y.

With these 2 carriers, the bank expects Apple’s addressable 3G market in China will grow to approximately 220 million subscribers.

Perhaps of even greater significance, states the bank, is the potential addition of China Mobile as a carrier which would be a significant growth driver as it has the largest number of mobile subscribers in China (600 million 2G and approximately 51 million 3G) with 3G subscribers growing 45%+.

The report continues…assuming China Mobile began selling the iPhone in 2013 Apple’s addressable market would more than double from approximately 150 million 3G units in 2012 to approximately 350 million in 2013.

Although China Mobile does not currently sell the iPhone, it reportedly already has more than 15 million iPhones running on its network (voice + WiFi as the iPhone does not support TD-SCDMA), demonstrating significant demand among China Mobile customers.

China Unicom + China Telecom wireless subscribers (2G and 3G)

3G Subscriber split (China Telecom, China Mobile, China Unicom)

Apple has ample share opportunity for share gains in China and APAC

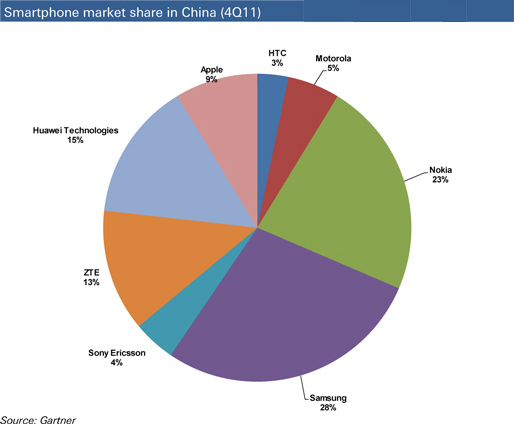

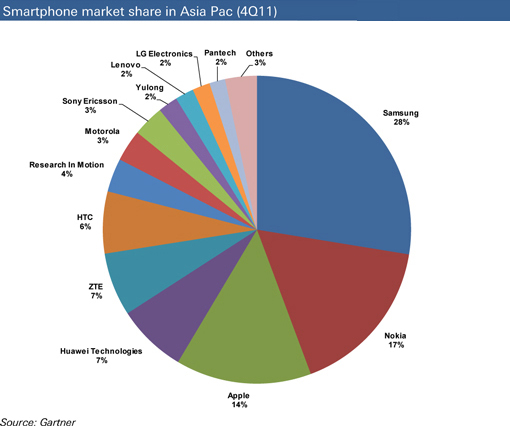

As highlighted in the banks report, below, as of 4Q11, Samsung is the dominant handset vendor in China and Asia Pac with 28% market share (in both China and APAC).

In China, Nokia is the second largest vendor with 23% share followed by ZTE (13%),

Huawei (15%) and Apple (9%). In APAC, Samsung is followed by Nokia (17%) and Apple (14%).

Going forward, Deutsche Bank states in the report it believes Apple has ample opportunity for share gains since it recently signed China Telecom and could announce a deal with China Mobile by year-end or early 2013.

By comparison, Apple currently has approximately 43% of the smartphone market in North America which is all the more impressive considering that Apple did not compete in the smartphone business prior to 2Q07.

Smartphone market share in China (4Q11)

Smartphone market share in Asia Pac (4Q11)

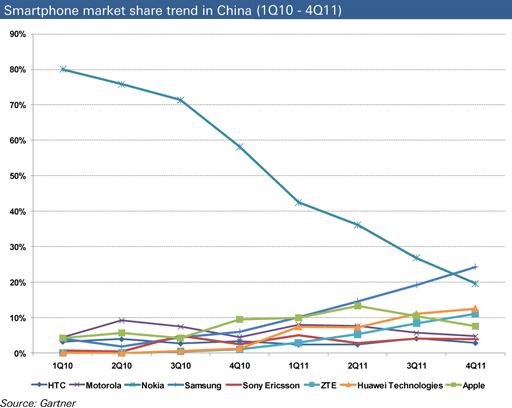

Smartphone market share trend in China (1Q10 – 4Q11)

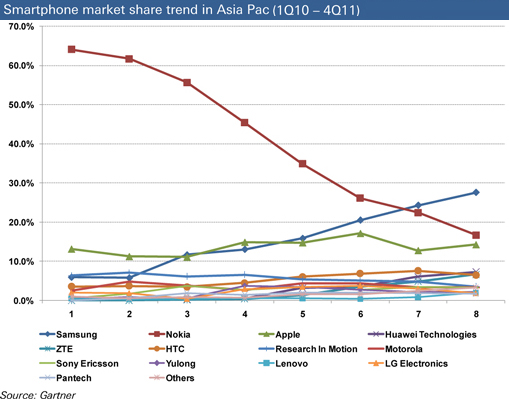

Smartphone market share trend in Asia Pac (1Q11 – 4Q11)

Deutsche Bank acknowledges contributions for this report by Sachith Jayakody and Qadhir Sheriff, both with Amba Research Lanka (Private) Limited, a third-party provider to Deutsche Bank of offshore research support services.

Get list of EMS manufacturers for your requirements (Its free)

Save time and money. Find quality EMS manufacturers. Fast. Venture Outsource has a massive, global database of contract electronic design and manufacturing capabilities. Speak with a Provider Advisor.

“Was able to very quickly find details on the important elements of setting up EMS and ODM partnerships, talked with an advisor for personalized info on quality providers matching our requirements while getting up to speed quickly about the industry and connect with key staff from like-minded companies and potential partners. Great resource.”

— Jeff Treuhaft, Sr. Vice President, Fusion-IO

Advisors tell you matches we find for your needs, answer your questions and, can share EMS industry knowledge specific to your industries and markets.