The group of contract manufacturers known as electronics manufacturing services (EMS) providers has long coveted the business of medical device manufacturers, and in many respects that fit is a good one.

The number of medical devices that make use of sophisticated software and integrated circuitry has been on the rise for more than a decade.

Medtech manufacturers can find it difficult to justify full-time staffing for assembly of complex products that are produced in relatively low volumes. And, especially important for EMS providers, this class of subcontracting would seem to hold the promise of good profit margins.

In other respects, however, the connection between medtech manufacturers and EMS providers is a distant one. Medical product manufacturing is a global industry that is expected to reach nearly $190 billion in 2004, with estimated annual growth of 6.5%.(1)

But the amount that medtech companies spend on manufacturing is only a fraction of that sum—and even less is devoted specifically to medical electronics.

EMS providers that have taken the time to review such numbers might be forgiven for losing the gleam of dollar signs in their eyes.

Meanwhile, the global market for electronics manufacturing services in 2003 was roughly $90 billion, a total that is expected to grow to $132 billion by 2008.(2) So even if EMS providers don’t exactly consider medtech companies to be small potatoes, many have adopted a circumspect attitude toward the revenue potential of the device industry.

RELATED DOCUMENTS

Contract Agreement for EMS Medical Device Design Services (7 pages)

Contract Agreement for EMS Medical Device Manufacturing Services (14 pages)

But all of that could be changing. This article looks at emerging trends affecting the development of medical electronics and how they may also influence the relationships among medtech manufacturers and EMS providers.

Changing Drivers

In the past, the primary force impelling medical device manufacturers to consider outsourcing their electronics manufacturing operations has been cost. Outsourcing such operations to EMS providers yields average cost savings of 10–15% when compared with a manufacturer’s costs for building and maintaining equivalent services in-house.(3)

However, EMS providers have been active in promoting other benefits of outsourcing as well. At a time when many medtech companies of all sizes have been pressed to minimize unnecessary expenses and eliminate wasteful operations, many functions traditionally performed within a company’s own walls have come under intense scrutiny. In some cases, company leaders have discovered that they can better concentrate on their company’s core competencies if they outsource certain noncore operations. Electronics manufacturing is often considered such an outsourceable function, and EMS providers have benefited from this trend.

By supplementing a company’s in-house research and engineering functions, outsourcing also offers advantages in terms of project scheduling. Expedited time to market is a benefit that is frequently highlighted by specialized outsourcing firms, including EMS providers. For medtech companies seeking a first-mover advantage, or those simply trying to meet the needs of a fast-paced and competitive market, speed to market can be a key factor in determining whether to outsource.

In search results, you can further target provider services criteria.

EMS providers have also captured the attention of medtech manufacturers by offering a range of services through facilities operating around the world, particularly in regions with low labor and overhead costs. A number of EMS firms can efficiently transfer full production of a manufacturer’s product from a factory in North America to one on another continent. When it comes to meeting the needs of the global medtech marketplace, multinational EMS providers that are able to penetrate new growth areas in China, India, and other emerging markets have a distinct advantage.

Despite such financial and other advantages, however, medtech executives have been slow to heed the call to outsource their electronics manufacturing operations. One obstacle has been the growing use of variable-asset business models, which require medtech executives to assign value to business units—including outsourced functions—according to their contribution to a company’s bottom line. When applied to the outsourcing equation, such models raise issues related to the visibility, responsiveness, and performance of the outsourcing firm, as well as the manufacturer’s ability to manage such elements of the outsourcing relationship. The difficulty of getting to the bottom of such issues—and deciding how they affect the value of a company’s functional assets—can sometimes prevent manufacturers from acknowledging the comparative value of outsourcing.

SEE ALSO

Manufacturing for FDA guidelines

Manufacturing plan (0-18 months) for tech hardware startups

Whatever the drivers for EMS outsourcing may have been in the past, however, they may soon be overtaken by an entirely new market trend. As medtech manufacturers design new generations of products that make use of increasingly sophisticated information technologies (IT), many companies may find their resources strained on a variety of levels. R&D teams will be challenged to develop new product software and user interfaces, process engineers will be challenged to devise efficient means of production, and company executives will be challenged to find ways to pay for it all.

In short, the coming generation of advanced IT-based medical devices creates a whole new driving force for outsourcing electronics manufacturing. The sophisticated requirements for producing such devices raises questions about how well prepared manufacturers are to build their own products. And it reopens the question of whether EMS providers can offer a cost-effective alternative for producing devices that meet the requirements of the heavily regulated medtech marketplace.

Over the past decade, advances in microelectronics have brought about significant changes in almost every conceivable industry. Often shrouded behind a cloud of business management technologies, such advances have changed the ways that companies are able to plan, schedule, and execute their business strategies, sometimes with revolutionary effects on entire industries. Consumer products have perhaps undergone the most change of all, making widely available whole new types of devices—from cell phones and personal digital assistants (PDAs) to digital cameras and headrest videoscreens—that would have been impossible at the beginning of the last decade.

While not exactly ignoring such advances in microelectronics, manufacturers of medical products have been somewhat slower to adopt them than other industries have been. Restricted by the need to ensure that their products meet regulatory requirements for safety and efficacy—and by the equally challenging need to identify competitive methods of manufacturing and maintenance—medtech companies have been more often found toward the end of the new-technology adoption curve than at its beginning.

Gradual advances in medical electronics have been matched almost step for step by medtech manufacturers’ use of EMS providers. The more sophisticated the product, the more likely a manufacturer is to outsource such operations as software development, component development and manufacturing, or final assembly. Manufacturers in the diagnostic imaging sector of the medical device industry have been particularly active in outsourcing to qualified EMS providers. The large and highly complex systems produced by such companies—including x-ray equipment, magnetic resonance imaging systems, computed tomography scanners, and instruments for other key imaging modalities—are natural candidates for outsourcing.

In search results, you can further target provider services criteria.

Not far behind the makers of imaging systems have been the manufacturers of patient monitors and diagnostic instruments for a wide variety of applications. Such products have typically been designed for use by healthcare professionals in clinical laboratories, surgical suites, or other hospital settings. But an increasing number of such devices are being approved for use in physicians’ offices or even for home-use by patients themselves.

Also active in outsourcing to EMS providers are the manufacturers of a broad spectrum of medical devices such as ophthalmic surgical systems, anesthesia workstations, and other small to medium-sized electromechanical devices. Makers of such systems have gradually reduced their size while also incorporating more feature-rich system electronics that have dramatically enhanced performance.

The ability to incorporate vastly greater computing power into ever-smaller devices, in fact, is one of the most important trends influencing the shape of today’s medical products. Miniaturization is driving the migration of intelligent devices from hospitals and clinics to the home. A typical example of such migration is found in the $2.3 billion market for daily blood-glucose monitoring of diabetics, which has been made possible by the development of pocket-sized personal glucose monitors.

In turn, the evolution of smaller and easier-to-use medical products has unleashed another force that holds great potential for reshaping the future of medical products. “A major trend in medical electronics is the consumerization of products and technologies,” says Jim Walker, vice president of research for semiconductor manufacturing and emerging technologies at Gartner Research (Stamford, CT).

The increasing involvement of consumers in making decisions about their own healthcare will certainly have implications for medical product developers and healthcare providers alike. To meet the demanding expectations of the aging baby-boom generation, for instance, manufacturers and providers have already begun to develop systems that can be used to monitor a patient’s key physiological parameters in almost any setting. While the core measurement technologies may be little changed from earlier generations, such products now interact with the patient and the healthcare system very differently.

In one such device, an electrocardiograph unit is integrated with a cell phone that the patient can place against his or her chest, thereby transmitting vital data to a clinician at a remote site. A patient feeling in danger can press the unit’s built-in panic button, which is connected to a global positioning system, automatically alerting a dispatcher to send an ambulance to the patient’s exact location. In the case of other products under development, such monitors take the form of wearable devices that automatically record a patient’s vital signs.

Such devices are making it possible for consumers to participate in every aspect of their own healthcare, including the collection of data essential for making a clinical diagnosis. “More and more, initial diagnostic screening will be done by the patient,” says Walker.

A single example that illustrates the convergence of several trends is the PillCam endoscopy camera-in-a-capsule created by Given Imaging Ltd. (Yoqneam, Israel). The product is essentially a miniaturized combination camera and transmitter, incorporating a camera imaging chip, a radio-frequency (RF) transmitter, a battery, and a miniature flashing light-emitting diode (LED), all in an 11 x 26-mm capsule. (Figure 1)

Figure 1

The PillCam device is designed to replace more-invasive procedures for identifying abnormalities in the small intestine, such as those resulting from Crohn’s disease, celiac disease, and benign and malignant tumors. In practice, the patient swallows the capsule, which takes pictures as it passes through the patient’s digestive tract. The device transmits image signals to an external receiver worn by the patient. Once the capsule is excreted, the patient brings the external receiver to the physician’s office where the images are downloaded for evaluation and diagnosis. Many health insurance companies encourage use of the FDA-approved capsule as a cost-effective initial diagnostic application.

Like many companies, Given Imaging retains certain elements of its product programs in-house and outsources others. Basic product development is handled internally. But development and manufacturing of specialized technologies, such as an application-specific integrated-circuit (ASIC) transmitter, are likely to be outsourced. Given writes specifications for the ASIC and partners with an ASIC house for actual development of the component.

For the PillCam, Given selected Pemstar Inc. (Rochester, MN) as its EMS partner. Given performs some of the product manufacturing and integration and Pemstar does the rest.

Since every medical product has unique characteristics and requirements for traceability and documentation, knowing the regulatory capabilities of an EMS provider can be an important factor in making such an outsourcing arrangement work properly. “We weighed the benefits of partnering with an EMS provider versus the additional complexity of complying with regulatory requirements,” reports Kevin Rubey, chief operating officer at Given Imaging. For Given, Rubey adds, “It was important to partner with a provider that understands regulatory protocol and practices.”

Further advances for such devices have the potential to bring about the long-awaited benefits of telemedicine. In this emerging field, the application of wireless medical technologies offers a seemingly endless growth horizon. When the nearest healthcare provider is necessarily far removed from the patient—or when the expertise of a distant specialist is urgently required—the ability to consult, diagnose, and deliver effective medical care remotely can be a matter of life and death.

In search results, you can further target provider services criteria.

Telemedicine technologies promise to achieve all of this, and more. Using such systems, patient samples can be tested and the results of medical exams can be transmitted digitally, thus supporting accurate diagnoses. And with the continued development of robotic surgical systems, it may eventually be possible for expert surgeons to perform sophisticated procedures remotely. Medtech manufacturers are actively developing hardware and software to facilitate these capabilities. Along the way, they are achieving ever-higher levels of system integration, as control over more and more functions is moved onto integrated- circuit microchips. And with increasing use of such miniaturized electronics, the overall size of such products is also getting smaller.

Advanced telemedicine systems may also reach the battlefield in the form of a wearable unit designed to monitor a soldier’s physiological signs. Such a unit could give medics the ability to assess a soldier’s overall condition or to determine the extent of injuries suffered in combat. By employing such a device for teletriage, medics would be able to plan medical treatment, or to confirm that the soldier had died, before risking additional personnel to retrieve the casualty. Full confidence in the reliability of such technology will be essential, since lives will depend on the delivery of accurate and timely information across hostile terrain.

Outsourcing Relationships

Although medtech companies are now pressing forward with new generations of medical electronics products, the increasing complexity of such devices can present obstacles even for sophisticated medtech manufacturers.

“Medical device companies understand medicine and science. But they may not have the same depth of knowledge in the networking, wireless, computer, and data communication technologies that are being incorporated into leading-edge medical electronics,” observes Brad Goskowicz, medical sector vice president for Plexus Technology Group (Neenah, WI), an EMS provider.

Dealing with such limitations on the in-house capabilities of medical device companies has led to a broad spectrum of relationships among medtech companies and EMS providers. On the most conservative end of the spectrum are those device companies that insist on performing all final assembly in-house and those that work closely with outsource partners only in the areas of quality, reliability, and testing. In many instances, such a conservative approach is dictated by the liabilities related to the company’s products, which perform life-sustaining functions. For products such as these, medtech manufacturers must balance concern about their own potential deficiencies against an equally reasonable concern about the ability of EMS providers to ensure the reliability of such advanced electromedical devices.

On the other end of the spectrum are an increasing number of device companies for which a full turnkey development program offers the greatest opportunities for success. In some cases, executives of such companies may approach contract manufacturers as soon as their patented technology has completed proof-of-principle testing. Companies at this end of the spectrum place a high value on early engagement with an EMS provider, which can lead to quicker design optimization for volume manufacture.

Wherever their companies may reside on the spectrum of outsourcing relationships, medtech executives are increasingly relying on EMS providers and contract manufacturers to complete the design and development of products conceived by their own companies. Such a strategy enables medtech companies to focus on their core competency in product innovation. It also offers the potential for enhanced supply-chain effectiveness by making it the responsibility of the EMS provider to manage the supply chain and related companies.

More often than not, within the EMS supply chain there are several subcontractor relationships tied directly to the manufacturer-EMS relationship. Subcontractors with a specialty in medical technologies are numerous and varied, offering services that range from component design and software development to full manufacturing and assembly. In some instances, the services provided by such subcontractors may rival those of EMS providers themselves, being distinguished chiefly by the scale of the companies’ operations.

When supply-chain management is outsourced to an EMS provider, it becomes that firm’s responsibility to determine which subcontractors are appropriate for the project and which are not. Although some contract manufacturers claim to offer design services for medical electronics, for instance, that doesn’t necessarily mean they’re good at it. Having design software and an engineer who knows how to use it is not sufficient.

The firms that typically offer the best design capabilities for medical electronics are those that have experience with a multitude of projects covering multiple medical markets, a demonstrated ability to keep iteration costs to a minimum, and the knowledge necessary to guide manufacturers through the inevitable maze of technological and regulatory issues related to their products. Key to the competence of such firms is having procedures in place to ensure that product designs accurately translate into manufacturing specifications.

A typical example of subcontracting within the EMS supply chain is offered by CEA Technologies Inc. (Colorado Springs, CO), a relatively small company that provides contract engineering and manufacturing services for custom critical-care medical devices.

One of the company’s recent projects involved a medical device manufacturer and EMS provider that jointly designed and developed a software-driven RF generator for use in tissue ablation. The role of CEA Technologies, working on behalf of the EMS provider, was to generate design specifications for the electrosurgical probe—the consumable element that actually transmits thermal energy to the tissue during ablation.

Similar services are provided by a large number of suppliers to the medical device industry, but not all such firms are content to serve in the role of subcontractor. Another medical electronics subcontractor that works with larger-tier EMS providers is Mack Technologies (Westford, MA).

When developing a new product, EMS providers and their subcontractors may run into many of the same problems that a device company’s in-house personnel would encounter. To resolve such challenges efficiently, it is important that all parties to the proj-ect maintain an attitude of cooperation, says Marcus Boggs, president of CEA Technologies. “In order for a partnership to work effectively, the relationship must be based upon honesty, openness, and a willingness to work together as a team,” he says.

Regulatory Compliance

Whether they are owned and operated by medtech manufacturers or by EMS providers, manufacturing facilities involved in the production of electromedical products are ultimately obliged to operate with full understanding of all regulatory requirements applicable to their processes and products. Consequently, a key concern of medtech executives is whether their prospective EMS partners have experience in meeting regulatory requirements such as those embodied in FDA’s quality system regulation.

A more difficult situation can arise when manufacturers are themselves unsure about such regulatory requirements. Long-established medtech companies typically have sophisticated quality and regulatory affairs functions capable of leading their outsourcing partners through the regulatory processes required to execute a successful product launch. But younger medtech companies sometimes do not have the scope or depth of regulatory understanding needed to play such a leadership role.

“Start-up medtech companies may not have a full compliance program in place,” says Brian Weller, director of quality and regulatory affairs in the medical solutions group of Flextronics (Singapore), the world’s largest EMS provider. “It’s one thing to qualify an EMS provider and make sure the provider’s factory is registered. But the start-up should also have a clear view of what it needs to do to comply with FDA regulations.”

In some cases, dealing with an experienced EMS provider can help a young company to overcome this limitation. Seasoned EMS providers that are equipped to handle medical device projects typically understand the regulatory approval process and can offer strong support in developing and manufacturing new products. Such contractors often maintain internal quality and regulatory programs designed especially to integrate with the medical device manufacturer’s internal capabilities and to fill the voids in the company’s product development program.

A key focus for such regulatory programs is the effort to control product documentation, which often presents problems for medtech manufacturers and their supply-chain partners. Whether trouble surfaces early on during the request for quote or later, when implementing an engineering change order to bring a product to revised specifications, the absence of accurate communication is likely the cause.

“Documentation is the number one risk factor in any medical product transfer,” asserts Tamim Hamid, vice president of global business and technology services with Sanmina-SCI Corp. (San Jose). “If the medical device manufacturer doesn’t have a product document management system, it’s virtually certain that the product’s device master record is not up-to-date.” In such instances, the EMS provider can be left with a lot of liability and the responsibility to ensure that it is using the latest version of the product’s design.

“When providers are working with back-revised documentation and engineering drawings, costly iterations and lost-opportunity costs can have immeasurable impact on both the manufacturer and the EMS provider,” warns Hamid. To avoid such problems, he advises, medtech manufacturers should ensure that each vendor in the supply chain has in place reliable systems that meet or exceed traceability and documentation requirements.

To mitigate other risks associated with the development of a new medical product, manufacturers should seek out EMS partners that incorporate fault tree analysis (FTA) and failure mode effects and criticality analysis (FMECA) in their manufacturing and related programs. FTA is a top-down method used to analyze a type of failure in terms of its potential causes among the parts and operations of a product. FMECA is a bottom-up method in which basic failures are generated, and the results examined in order to determine the ultimate effects of those failures on device function. Both types of program help to mitigate risk.

Expanding a manufacturer’s own systems for corrective and preventive action (CAPA) to include outsourcing partners is another effective way of suppressing risks associated with the development of a new medical product. Being able to develop and manage a CAPA plan well is a good way for medtech manufacturers to attract quality EMS partners and can add tremendous value to the supply chain. Not having such a plan in place can be costly.

Developing such a supply- chain–wide CAPA system should be initiated as soon as the manufacturer has reached agreement with its EMS provider, and should begin by defining the roles of the manufacturer and the EMS provider in the CAPA process. The manufacturer’s team and counterparts from the EMS provider should then develop a plan to manage problems that might surface in the factory and, particularly, in the field. They must not neglect to determine how the situation will be handled if a finished product passes all inspections and meets all requirements but then develops a problem in the field. Each of the EMS provider’s manufacturing sites should have a process for identifying and fixing problems that is coordinated with the overall CAPA plan.

In addition to meeting FDA requirements, some EMS manufacturing facilities are also certified to other standards that pertain to medical device manufacturing. Two of the more common certifications include the quality systems standards compiled by the International Organization for Standardization (ISO), ISO 13485 and ISO 13488.4,5 These standards are specific to medical device manufacturing and supplement more-generic ISO standards that apply to many industries. Additional medtech-specific requirements cover special processes, design controls, process controls, traceability, record retention, and regulatory actions. Another common registration for North American manufacturing facilities is for the Canadian medical devices conformity assessment system, which performs inspections of manufacturing facilities that distribute medtech products to Canada.

Selecting an Outsource Partner

Some medtech executives select their outsourcing partners casually, without basing the decisions on their appropriateness for meeting strategic objectives. Other executives use highly evolved, highly effective evaluation processes to help develop a short list of qualified potential partners.6 These processes involve thorough internal planning and discussion.

Equally important, medtech executives must have the means to decide whether the EMS providers under consideration will be able to execute a program in accordance with the manufacturer’s business and marketing plan. A medtech firm considering partnering with a small EMS firm, for instance, should make sure that the provider’s executive team has a history of driving productivity and adding value in fast-paced and demanding manufacturing and end-market environments.

Not all of the more than 3,000 EMS providers around the world offer services suitable for medical product manufacturing—let alone projects that incorporate advanced IT systems. Medtech executives will improve the likelihood of selecting good partners if they have an objective method for evaluating the capabilities of different contract manufacturers.7

Companies can maximize their preparedness for making outsourcing decisions by conducting thorough in-house discussions involving all the internal functional groups with a direct interest in the outsourcing initiative: operations, engineering, test, quality, and finance, for example. These discussions should result in the development of checklists to help bring to the surface and isolate concerns early on so that there will be few surprises at a more awkward later stage.

Executives can then leverage this knowledge base for the contract development and negotiation phases of an outsourcing arrangement. The aim should be to ensure that each functional group’s needs are met and reflected as contract requirements in the final agreement.

Medical device giant Guidant Corp. (Indianapolis) has an internal supplier’s-capability group that incorporates a six-sigma program. The company visits each supplier to benchmark its processes using six-sigma DMAIC (define, measure, analyze, improve, and control) tools.

Guidant has a standard for all suppliers. “It comes down to quality, customer service, technology, cost, and supply,” says Lee Sparks, director of supplier development for the company’s cardiac rhythm management division. “Guidant has not really had any major problems with providers because we do such a thorough job up front when identifying qualified providers. Those providers selected must understand that Guidant is looking for a long-term arrangement. We do not jump ship-to-ship.”

Guidant also does something extraordinary. Every two years, the company holds special supplier reviews. Patients using Guidant devices, some of whom have confronted life-threatening illnesses, are invited to come and share stories of their product experiences with company suppliers. The suppliers learn firsthand about their role in the supply chain. In addition, seeing how their services and products touch end-customers’ lives—in the most fundamental sense of the word—impresses upon them what is at stake and why the highest levels of process control, quality management, and system integration are essential.

Conclusion

For medical technology companies, developing the next generation of medical products that incorporate advanced information technologies will present significant technological challenges. But manufacturing such complex products with existing company resources may prove equally difficult. Medtech executives may soon find that outsourcing certain operations to qualified EMS providers is a strategy worth pursuing.

When doing so, however, company leaders should be prepared to manage the complex of business relationships that go along with outsourcing. Executives who are able to conceive and incorporate in their outsource contracts well-defined and properly crafted requirements that optimize flexibility and mitigate risk will be more competitive than industry colleagues who are not. And those who are able to develop and encourage open, supportive relationships with their outsourcing partners will be more likely to succeed in such a venture.

REFERENCES

A Kinross, “As Outsourcing Increases, So Does Consolidation,” Medical Device & Diagnostic Industry 26, no. 3, Guide to Outsourcing [supplement] (2004): S-22–S-28.

Forecast: Electronics Manufacturing Services, Worldwide (Stamford, CT: Gartner, 2004).

The Electronics Outsourcing Report (San Jose: Venture Outsource, 2004).

“Medical Devices: Quality Management Systems; Requirements for Regulatory Purposes,” ISO 13485 (Geneva: International Organization for Standardization, 2003).

“Quality Systems: Medical Devices; Particular Requirements for the Application of ISO 9002,” ISO 13488 (Geneva: International Organization for Standardization, 1996).

Cost-Benefit Analysis (San Jose: Venture Outsource, 2004).

Contract Electronics Manufacturer Evaluation (San Jose: Venture Outsource, 2004).

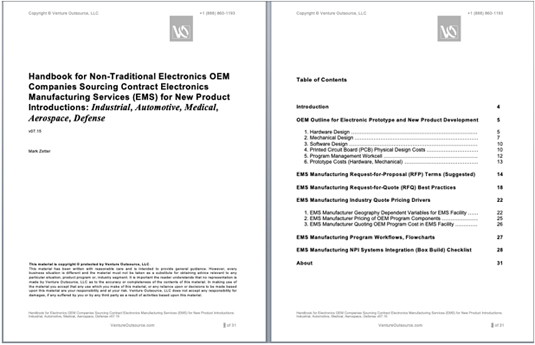

Medical Electronics New Product Launch and NPI Management in EMS Manufacturing

Learn more about medical electronics new product NPI program launch and cost management with the Venture Outsource 30-page handbook you can request here.

Designed for non-traditional electronics OEM companies, our handbook is divided into the primary topics below, with several topics going deeper, with detailed industry examples and clear suggestions and checklists for readers to consider:

- OEM Outline for Electronic Prototype and New Product Development

- EMS Manufacturing Request-for-Proposal (RFP) Terms

- EMS Manufacturing Request-for-Quote (RFQ) Best Practices

- EMS Manufacturing Industry Quote Pricing Drivers

- EMS Manufacturing Program Workflows, Flowcharts

- EMS Manufacturing NPI Systems Integration (Box Build) Checklist

Our handbook can help guide medical electronics OEM manufacturers when formulating and benchmarking their new product launch roadmap and pricing strategy. Request this handbook.

Get your list of EMS manufacturers (Its free)

Save time and money. Find quality EMS manufacturers. Fast. Venture Outsource has a massive, global database of contract electronic design and manufacturing capabilities. Speak with a Provider Advisor.

“Was able to very quickly find details on the important elements of setting up EMS and ODM partnerships, talked with an advisor for personalized info on quality providers matching our requirements while getting up to speed quickly about the industry and connect with key staff from like-minded companies and potential partners. Great resource.”

— Jeff Treuhaft, Sr. Vice President, Fusion-IO

Advisors tell you matches we find for your needs, answer your questions and, can share EMS industry knowledge specific to your industries and markets.