As a major electronics original design manufacturing (ODM) destination for computers, communication products, consumer electronics and related components to the world, to many it only makes sense in the long run that Taiwanese and Asian companies may have an advantage in developing products for use in the fast evolving IoT market, writes investment bank UBS in a recent report. Naturally, providers of electronics services plan to participate given forecasted electronics services opportunities through 2019 or ODM and electronics manufacturing services (EMS) companies.

Total IoT end-user spend by vertical industry

Compared to Western electronics design, OEM and EMS companies, UBS states another bonus point for Taiwanese companies is the excess of engineering talent derived from Taiwan’s leading role in the marketplace as a major global electronics supplier.

In your search results you can further target other Industries and/or Services plus, you can add more geographies to your search.

While the IoT segment may not be capital or labor-intensive, UBS believes this segment will require hiring significant numbers of R&D engineers in the future because each product requires a high degree of customization due to the high-mix / low-volume nature of the business.

According to Gartner, manufacturing is probably when it comes to being one of the biggest potential spenders on IoT services, driven by the fact sector companies typically deploy large connected instrumentation and control systems.

UBS believes IoT-related implementation will be faster where noteworthy and measurable financial metrics will support a strong incentive for manufacturers to implement new technologies to benefit their P&L.

Most consumer electronics companies in Taiwan are component, ODM, or EMS providers to global OEM brands, but seldom sell under their own brand name. IPC in the charts below refers to industrial electronics PC vendors.

Taiwan IPC sales breakdown between own brand and ODM/EMS (2014E)

The above situation is considerably different from the IoT segment where many key vendors sell under their own brand.

In your search results you can further target other Industries and/or Services plus, you can add more geographies to your search.

UBS thinks own-brand and success in getting customers to associate brands with quality, reliability and service are additional reasons why IoT vendors have higher margins.

Distribution Taiwan IPC companies own brand vs. ODM/EMS only companies (2014E)

It would make sense for EMS providers to invest more heavily in firmware development and embedded technologies. From this perspective ODMs are ahead of the curve.

For a broader look at the implications and opportunities related to the Internet of Things, consider the slide below. It is from the deck from our earlier, popular (archived) online Webinar: Future of Computing: Pervasive Computing and the Internet of Things, presented by IDC’s Michael Palma, research manager, semiconductors & enabling technologies.

Industrial Electronics New Product Launch and NPI Management

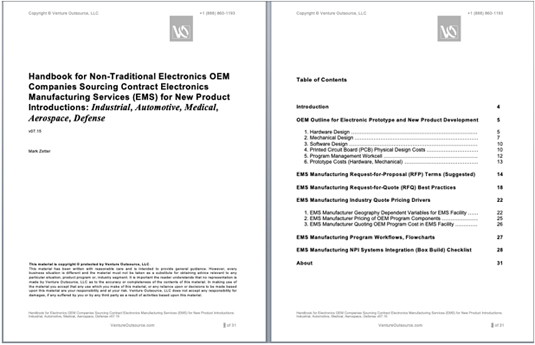

Learn more about industrial electronics new product NPI program launch and cost management in our 30-page handbook you can request here.

Designed for non-traditional electronics OEM companies, our handbook is divided into the primary topics below, with several topics going deeper, with detailed industry examples and clear suggestions and checklists for readers to consider:

- OEM Outline for Electronic Prototype and New Product Development

- EMS Manufacturing Request-for-Proposal (RFP) Terms

- EMS Manufacturing Request-for-Quote (RFQ) Best Practices

- EMS Manufacturing Industry Quote Pricing Drivers

- EMS Manufacturing Program Workflows, Flowcharts

- EMS Manufacturing NPI Systems Integration (Box Build) Checklist

Our handbook can help guide industrial electronics OEM manufacturers when formulating and benchmarking their new product launch roadmap and pricing strategy. Request this handbook.

Get a list of EMS manufacturers matching your program needs (Its free)

Venture Outsource has the largest, global database of contract electronics capabilities. Get a free list of contract EMS manufacturing companies matching your program needs.

“Was able to very quickly find details on the important elements of setting up EMS and ODM partnerships, talked with an advisor for personalized info on quality providers matching our requirements while getting up to speed quickly about the industry and connect with key staff from like-minded companies and potential partners. Great resource.”

— Jeff Treuhaft, Sr. Vice President, Fusion-IO

Advisors have access to detailed information on listings in our global database and can help you compare provider service capabilities to better match your program needs. Speak with a Provider Advisor. This free service is for electronic professionals working in OEM brand companies.