Despite lingering weakness in the global economy and continuing uncertainty in technology markets, the outsourced manufacturing industry is expected to post moderate revenue growth this year as original equipment manufacturers (OEM) increase their outsourcing activities to capitalize on opportunities for expansion across multiple industries including consumer electronics, industrial electronics and automotive electronics, according to analytics firm IHS.

Revenue in 2013 for the worldwide outsourced manufacturing industry is forecast to reach US$404.5 billion, up 4.5 percent from $387.0 billion last year.

While growth for 2013 is slightly down from the estimated 5.0 percent rise the industry enjoyed in 2012, the next few years appear on track for solidly reliable — if unspectacular— rates of increase provided the global economy cooperates.

By 2016, contract electronics revenues will amount to $451.9 billion, as shown in attached figure, following the industry’s recovery from the declines seen in 2008 – 09.

Potential economic troubles that could undermine market growth include the sovereign debt crisis in Europe and the U.S. response to realigning its long-term spending trajectory.

Providers and customers driving opposing forces

2013 will also see the industry attempt to balance two key trends, each likely to pull in the opposite direction: OEM customers wishing to lower their costs on one hand, versus outsourced manufacturing providers hoping to see improved cash flow on the other.

In your search results you can further target other Industries and/or Services plus, you can add more geographies to your search.

From their end, OEM customers will want to know what price is considered fair to pay an outsourced provider in order to make their product thus forming part of the client’s effort to reduce overall manufacturing costs. See: Understanding provider contract agreements and cost)

For providers, on the other hand, concerns will focus around how to reduce inventory in order to achieve a stronger provider balance sheet; how to do more with less, especially in the area of capital expenditures; and how to bring down operating costs as a whole.

In essence, how both themes play out this intricate interplay — between hard-nosed OEM customers wanting lower prices but faster supply chain responsiveness and cash-generation focused manufacturing providers -— will prove of great interest.

The next big player

One issue of interest to the industry revolves around which organization will become the next big player to drive the space. In the past decade, for instance, particular customers or end markets fueled growth, only to be superseded by other actors and variables.

First came contract electronics industry growth via the consolidation of assets spun out of OEMs. This was followed by a massive asset shift to China as it became the hub of outsourced manufacturing. (See: Managing China supply chains)

Ultimately, this led to the rise of consumer electronics products such as smartphones and tablets, which served as palpable tickets to success for both clients and their manufacturing partners alike.

In your search results, you will be able to further target provider options by choosing End Markets and/or other Services.

The industry has shifted somewhat the past few years as it then turned its attention to industrial and higher mix customers as a means to drive growth, with consumer-focused companies becoming the somewhat less favored entities afterward. Now, the bet is being made on an alliance of sorts between those last two forces.

Growth remains with consumer-oriented companies that make the gadgets desired by the purchasing public everywhere, but those companies in turn are spurring enterprises to help companies capitalize on new ways to grow.

These new highways to growth include consumer traffic, commerce and data—avenues that can be exploited by devices like smartphones, tablets, and other interactive ‘smart’ devices.

Industrial Electronics New Product Launch and NPI Management

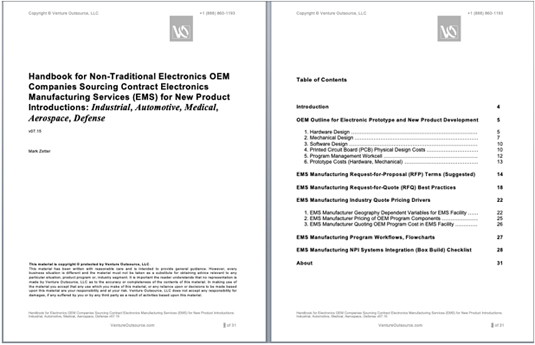

Learn more about industrial electronics new product NPI program launch and cost management with the Venture Outsource 30-page handbook you can request here.

Designed for non-traditional electronics OEM companies, our handbook is divided into the primary topics below, with several topics going deeper, with detailed industry examples and clear suggestions and checklists for readers to consider:

- OEM Outline for Electronic Prototype and New Product Development

- EMS Manufacturing Request-for-Proposal (RFP) Terms

- EMS Manufacturing Request-for-Quote (RFQ) Best Practices

- EMS Manufacturing Industry Quote Pricing Drivers

- EMS Manufacturing Program Workflows, Flowcharts

- EMS Manufacturing NPI Systems Integration (Box Build) Checklist

Our handbook can help guide industrial electronics OEM manufacturers when formulating and benchmarking their new product launch roadmap and pricing strategy. Request this handbook.

Get a list of EMS manufacturers matching your program needs (Its free)

Venture Outsource has the largest, global database of contract electronics capabilities. Get a free list of contract EMS manufacturing companies matching your program needs.

“Was able to very quickly find details on the important elements of setting up EMS and ODM partnerships, talked with an advisor for personalized info on quality providers matching our requirements while getting up to speed quickly about the industry and connect with key staff from like-minded companies and potential partners. Great resource.”

— Jeff Treuhaft, Sr. Vice President, Fusion-IO

Advisors have access to detailed information on listings in our global database and can help you compare provider service capabilities to better match your program needs. Speak with a Provider Advisor. This free service is for electronic professionals working in OEM brand companies.